Important Downloads

Letter to Members of Adjala Credit Union Limited

Partnering Credit Unions

Main Benefits of the Transaction

For the Benefit of Adjala’s Members

Enhanced Product Offerings and Service Quality

More Affordable Banking

For the Benefit of Adjala’s Employees

For the Benefit of Our Communities

For the Benefit of the Credit Union System

Member Impact

Our Commitment

Timeline

How the Buyer Will Operate after Closing

Adjala Advisory Committee

IMPORTANT DOWNLOADS

Letter to Members of Adjala Credit Union Limited

Adjala Credit Union Limited (“Adjala”) is pleased to present this information package detailing the proposed transaction whereby Adjala would transfer substantially all of its assets to St. Stanislaus-St. Casmir’s Polish Parishes Credit Union Limited (the “Buyer”) and the Buyer would assume substantially all of Adjala’s liabilities.

Following closing of the proposed transaction, and subject to the receipt of regulatory approval, the Buyer plans to carry on the Adjala business using the trade name “Adjala Savings, Branch of Blue Group Savings”.

The following information package was prepared by the Buyer and summarizes the proposed transaction, its benefits to Adjala members, and the planned transition process that will follow the closing of the transaction.

Yours truly,

John Munnoch

Chief Executive Officer

Partnering Credit Unions Adjala Buyer

| Adjala | Buyer | |

|---|---|---|

| Founded In | 1946 | 1945 |

| Headquartered | Colgan | Milton |

| Number of Members | 700 | 15,100 |

| Number of Employees | 6 | 70 |

| Number of Branches | 1 | 6 |

| Assets Under Management | 23,000,000 | 553,000,000 |

| Lines of Business | Personal, Business | Personal, Business, Wealth, Agriculture |

Main Benefits of the Transaction

| Name and Brand Retention |

Key benefits of the transaction are the retention of Adjala’s well-established brand and name. This continuity ensures that members and the community will continue to recognize and trust the familiar identity of Adjala.

|

| Legacy |

By preserving the Adjala’s legacy, the transaction builds on its local reputation and long-standing relationship with its members, fostering confidence and maintaining the deep-rooted connection it has with the community.

|

| Enhanced Member Value |

The Buyer will be able to offer members differentiated value propositions through enhanced services.

|

| Increased Capacity Digital Solutions |

Reduce duplication and increase the ability to afford the rising costs of digitization, including digital banking, payments modernization, and open banking.

|

| Leveraged Strategic Partnerships |

Utilizing strategic partnerships to advance key priorities of the Buyer.

|

| Strengthened Risk Management: |

Building risk management capabilities that align with the Buyer’s size, scope, and complexity.

|

| Leadership Development: |

Enhancing leadership skills and competencies to achieve strategic goals and meet regulatory requirements.

|

For the Benefit of Adjala’s Members

The proposed transaction will result in members having access to a wider range of products and services, including secure online banking solutions, Registered savings products which include personalized advisory services tailored to meet the diverse needs of our members. Following closing, the increased scale of the Buyer will enable greater investment in member-focused initiatives, such as improved customer service, and expanded branch networks, ensuring greater convenience and accessibility for all members.

Enhanced Product Offerings and Service Quality

Members will benefit from integration of the Buyer’s superior digital solutions. All members, including small and medium-sized enterprises (SMEs) will have access to enhanced services including a secure online application platiorm with dual authentication, deposit capture, loan payments, bill payments, e-transfers, e-mail alerts, and cheque orders.

Members will have access to a broader array of wealth management services including professional financial advice, RRSPs, RRIFs, TFSAs, and GICs.

Business and agricultural members will benefit from higher single member lending limits, enabling the credit union to beter support their evolving business lending needs.

Buyer will invest in enhanced training and career development opportunities, allowing us to retain top-quality financial services employees.

Upon closing, members will have access to increased branch network. Stretching from Chesley to Toronto. Branches remain a key priority for members, and this expanded coverage will benefit our members.

More Affordable Banking

The increased scale of the Buyer will allow us to offer more competitive pricing options to members. With greater buying power, we aim to pass these savings on to members through more competitive account and service fees. Additionally, with higher lending limits, the Buyer will be able to effectively price and serve a broader range of business owners, farm owners and SMEs.

For the Benefit of Adjala’s Employees

The proposed transaction offers significant benefits for employees of Adjala. Creating a vibrant and rewarding work environment by combining resources and expertise, we will be able to provide enhanced professional development opportunities, including advanced training programs and career advancement pathways, enabling employees to broaden their skills and grow within the Buyer.

The increased scale of the Buyer brings greater stability and job security, with expanded career prospects and more opportunities for collaboration and teamwork.

The Buyer will be better positioned to attract and retain top talent by offering competitive compensation packages and will foster a supportive workplace culture that values employee well- being. This presents an exciting opportunity for employees to thrive professionally while contributing to the Buyer’s continued success and growth.

- A larger organization opens up more opportunities for career advancement.

- Employees will have access to a wider range of learning and development opportunities.

- We will build a culture that leverages the strengths of each organization, empowering our people and driving our organization to new heights.

- New opportunities will arise to foster teamwork and collaboration across the organization.

- Collaboration will bring fresh perspectives on common challenges.

- Employees will have the chance to achieve great things alongside like-minded professionals who share a passion for credit unions, cooperative banking, and exceptional member service.

For the Benefit of Our Communities

The proposed transaction promises significant benefits for the communities we serve. As a larger and more resilient financial institution, we will be able to offer community members expanded access to essential banking services, such as affordable loans, savings products, and financial literacy programs tailored to their specific needs.

With the combined resources we can deepen our commitment to community development initiatives. These initiatives will address local challenges and promote economic growth. Increased resources will create more opportunities for employee volunteerism and community engagement, strengthening our connections with local organizations and residents. With more resources, we can foster deeper connections and a stronger sense of belonging within the communities we serve.

Greater investment in community initiatives will increase our support for initiatives that build financially strong communities where people want to live, work, and stay.

For the Benefit of the Credit Union System

The proposed transaction offers benefits to the credit union system by fostering collaboration and reinforcing the core principles of cooperative banking. By uniting resources, expertise, and scale, the Buyer will showcase the strength and resilience of credit unions in a competitive financial environment. It provides a unique opportunity to amplify our voice and influence within the broader system, advocating for the growth and evolution of the credit union movement.

By joining forces, we significantly increase our size and scale, which enhances our collective ability to effect change and drive progress across the industry. With a larger membership base and expanded resources, we can more effectively advocate for policies and initiatives that benefit all credit unions, including regulatory reforms, legislative advocacy, and the promotion of financial inclusion.

Member Impact

This transaction represents an exciting opportunity for growth, innovation, and collective impact. We acknowledge that this transition may cause some disruptions as we align our operations and resources.

One area where you may experience changes is in the harmonization of products and services. As we integrate, adjustments to our offerings may occur, ranging from enhancements to existing services or modifications to certain features. Please be assured that these changes will be made with careful consideration of your needs, aiming to ultimately enhance the value we provide to you, our valued members.

While the Adjala location, branding and name will be retained, you might notice shifts in public presentation. This could include updates to advertising strategies, websites, and other communication materials. While these changes may initially seem unfamiliar, they reflect both Adjala and the Buyer’s commitment to creating a cohesive and forward-thinking identity.

Our Commitment

Throughout this transition, we want to reaffirm our unwavering dedication to you, our future members. Your satisfaction, well-being, and success remain our top priorities as we navigate this change. We will keep you informed every step of the way through, newsleters, and website updates about our progress and any changes that may affect you.

Oversight will be established through the proposed Advisory Commitee which will oversee the integration process and ensure that the interests of all stakeholders, including you, are considered in every decision. This commitee will provide high-level guidance and direction to Blue Group Savings and shape the future of our organization in your best interest.

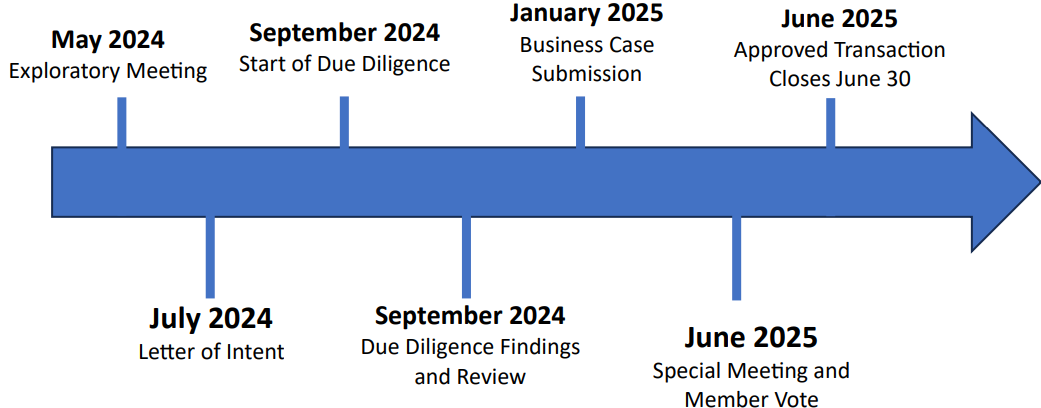

Timeline

How the Buyer Will Operate after Closing

The current Adjala business will be operated atier acquisition as part of the Buyer, at Adjala’s current location, with current staff and existing hours of operation.

Name

The legal name of the Buyer will be St. Stanislaus-St. Casmir’s Polish Parishes Credit Union Limited. It is intended that the trade name “Adjala Savings, Branch of Blue Group Savings” will be used to referred to the business of Adjala, subject to the receipt of regulatory approval.

Registered Office

The Buyer will have a registered office at 12005 Steeles Ave, Georgetown, ON, L7G 4S6, Canada.

Membership Shares

On closing of the transaction, all transferring Adjala members will be given 10 membership shares of the Buyer with an aggregate dollar value of $100.

Products and Services

The Buyer will continue to offer a full suite of deposit, and loan products and services for retail and commercial members. Over time, the Buyer will have the opportunity to offer more to members with enhanced products and services. The Buyer anticipates that enhanced products will be available shortly atier closing.

Adjala Advisory Commitee

Member Advisory Commitee Sound governance serves as the cornerstone of credit unions, embodying the essence of its strategic operations and direction.

The Members’ Commitee of the Buyer, known as the “Adjala Advisory Commitee,” is a new commitee that will be created by the Buyer’s Board effective following the transaction. This will encourage, promote and ensure that former Adjala members have a distinct voice concerning the governance of the Buyer. Initially, 3-5 members of the existing Adjala Board of Directors will be asked to participate and devote their relevant time and expertise to represent the interests of all members of Adjala District. Each member of the Adjala Advisory Commitee shall hold the position for a term of three years and shall be eligible to participate for up to three consecutive terms.

The Adjala Advisory Commitee will actively engage with its local members to ensure an open flow of dialogue, make recommendations and contribute to the exchange of information and ideas that will assist to further the interests of the local operation.

The Adjala Advisory Commitee shall meet at least three (3) times in each year. Meetings may be hosted at a physical location and/or virtually. Two (2) members of the Adjala Advisory Commitee are required for quorum for the transaction of business at all meetings of the Adjala Advisory Commitee.

Talk to us

Contact us about this transaction or you can use our online form.